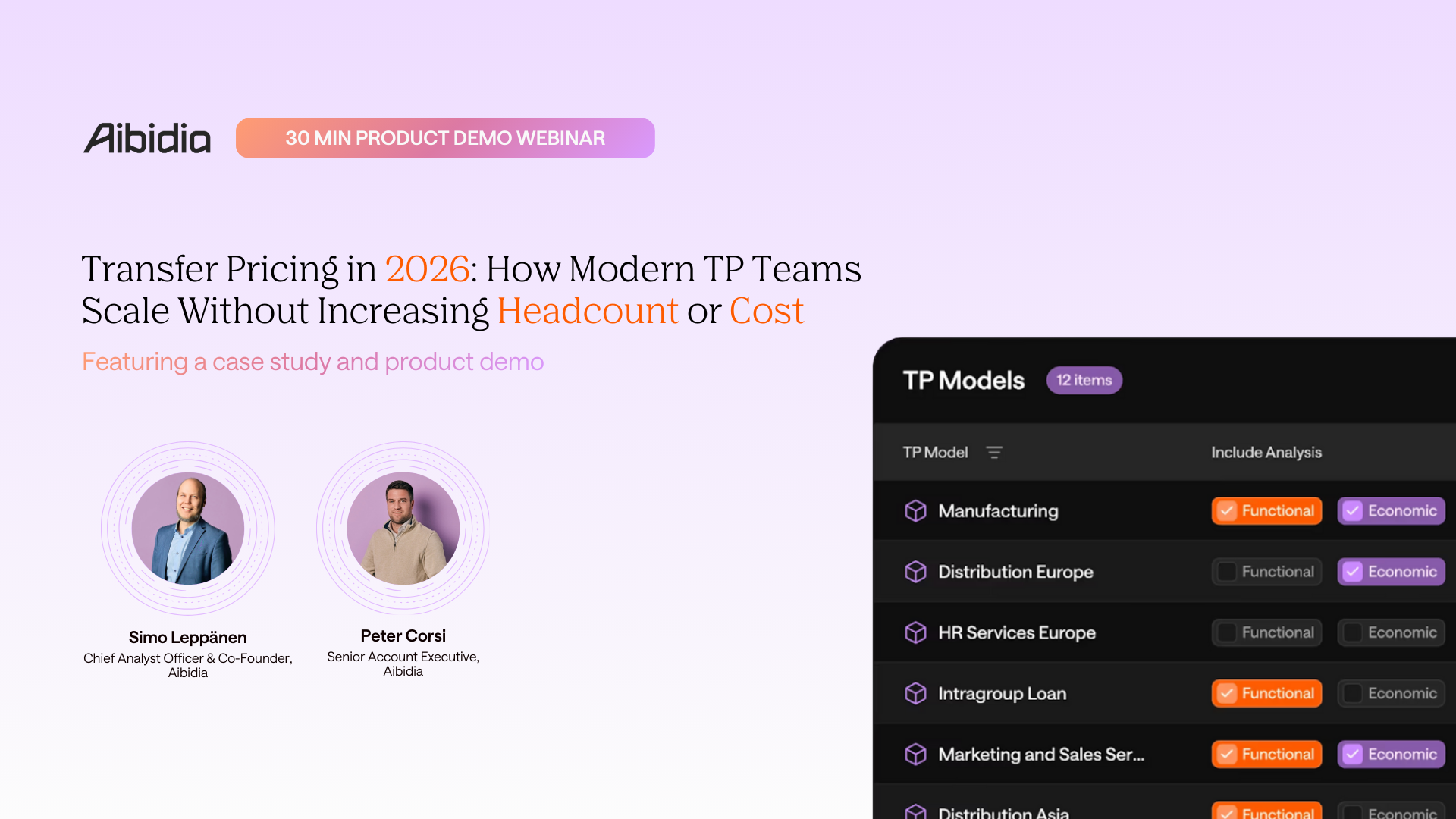

2026 is pushing tax and TP teams to rethink their operating models. Manual processes, Excel dependency, and fragmented workflows will not scale to meet the growing documentation requirements and audit scrutiny, particularly for teams expected to deliver more without additional resources.

Start building a reliable and scalable TP process this year.

Based on a real-life use case, we will show you how you can:

- Automate core TP processes for up to 80% time savings and cost reduction

- Gain on-time visibility over documentation, workflows, and arm’s-length status

- Collaborate easily across finance (including local controllers), tax and TP teams in a single environment

- Build a scalable TP foundation by harmonising data, ensuring compliance, and removing the human-error risk that slows teams down today

- Maintain compliance and audit readiness at scale with global coverage

- Produce high-quality, defensible benchmarks faster and at a lower cost

- Access expert execution and TP advisory support when needed, without expanding your team

.png)

.png)

![[On Demand] From Spreadsheets to Software: TP Technology & AI Trends You Can’t Ignore](https://cdn.prod.website-files.com/652d101c1d03208622e6844d/693139730a21749d14efe6f0_Webflow%20thumbnail%20banner%20(43).png)

.png)

.png)

.png)

.svg)